Qantas Soars With $2.39b Profit as Jetstar Shines and New Fleet Takes Off

Qantas has released its 2025 Annual Report, delivering outstanding results. The

airline posted a profit of $2.39 billion—up 15% on 2024 and only slightly below the

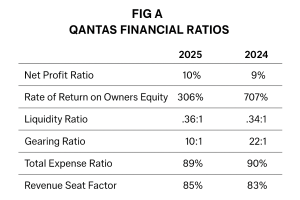

2023 record of $2.46 billion. All of Qantas’ key ratios—profitability, liquidity, solvency,

and efficiency—showed improvement (see Attachment below).

Chief Executive Vanessa Hudson said the profit surge was fuelled by a sharp

rebound in passenger demand and easing fuel costs. The airline carried an extra

four million travellers over the year, with both domestic and international routes

contributing to the growth.

All divisions delivered strong results, but the standout was budget carrier Jetstar,

which recorded a 16% jump in revenue to $5.7 billion and a 55% surge in earnings to

$769 million.

Shareholders of the ASX-listed $17 billion airline will share in the success, with

Qantas declaring a fully franked dividend of 16.5 cents per share, plus a special

dividend of 9.9 cents. Meanwhile, around 25,000 employees will benefit from a new

share scheme, granting them $1,000 worth of equity this year.

Qantas’ 2025 results do not factor in the $90 million fine it faces for illegally

outsourcing ground staff or the $36 million cost of shutting down Jetstar Asia.

The airline also confirmed a major fleet upgrade, announcing the purchase of 20 new

Airbus A321XLR aircraft to replace its retiring Boeing 737s and support the group’s

363-strong fleet. Adding to the excitement was the much-anticipated arrival of the

custom-built Airbus A350-1000s, designed to operate Qantas’ ultra-long-haul Project

Sunrise flights of more than 20 hours.

The first of 12 A350-1000s will enter final assembly at Airbus’ Toulouse factory in

October, with delivery to Australia expected a year later. In total, Qantas has 214

aircraft on firm order across the group, including Jetstar, with new planes scheduled

to arrive at an average rate of one every three weeks over the next two years.

Following its strong profit result, Qantas has relaunched its “double status credits”

offer to boost bookings and reward loyalty. Frequent Flyers who book within seven

days for travel between September 4 and August 22 can earn either double status

credits or double points.

NB: Qantas reports using underlying profit, a measure that excludes one-off costs or

gains to provide a clearer picture of the company’s performance. Some ratios—such

as the Rate of Return on Owners’ Equity and the Gearing Ratio—have recently

reached almost mythical levels, largely due to the accumulated losses from COVID-

19, which wiped out the equity section of Qantas’ Balance Sheet and reduced

revenues in the Income Statement. Because of this, financial analysts often avoid

relying on the traditional debt-to-equity ratio when assessing airline performance,

instead using more complex measures. While we are still awaiting reports from

several analysts, for now I have referred to the Gearing Ratio published by

stockanalysis.com.

Source: Qantas posts second biggest profit on record on back of soaring passenger revenue by Robyn Ironside The Australian Aug 28 th .